How to budget like a #boss: Introducing the 50/30/20 rule

We hate to see it, but another year has officially come to an end. And while we’ll definitely miss the excitement of the holiday season, I’ve always found the idea of a new year and the fresh start that comes with it really exciting. So, as you kick off 2024 and give some thought to what you’d like to accomplish this year, don’t forget about your financial goals!

We’ve all been there, maybe you balled out with gift-giving and now it’s time to rein things in a bit, or on the flip side, you were able to work a ton of hours this winter break but need to cut back during the school year. In either case, this is the perfect time to revisit your budget and adopt what we like to call the magic formula: the 50/30/20 rule. ✨

Tell me more… 👀

We love this formula because it’s simple, easy to follow and can flex with you during various life stages when your financial situation or goals may change.

Here’s how it works: Look at your take-home pay (aka the 💰left after taxes are removed) and break that down into a budget with 3 distinct categories:

Needs (50%)

Wants (30%)

Savings (20%)

Let’s say you’re taking home $1,000 per month from a part-time job. This means you would set aside $500 for needs, $300 for wants and $200 for savings. Okay, now it’s time for the fun part, figuring out what the heck goes in each category! 👇

How to break down your needs, wants & savings

Think of it like this, without these things, you’d have to go all Hunger Games status. These are the essential things that you need to go about your everyday life.

Groceries 🛒

Transportation 🚗

Cell phone plan 📱

Health insurance 🩺

Rent or mortgage 🏠

Utilities (like gas, electric & wifi) 🔌

Student loan or credit card payments 🧾

⭐Pro tip: If you’re looking to cut down on these costs, you can always consider carpooling with friends, swapping Whole Foods for Trader Joe's groceries or shopping around for a better deal on your cell phone plan.

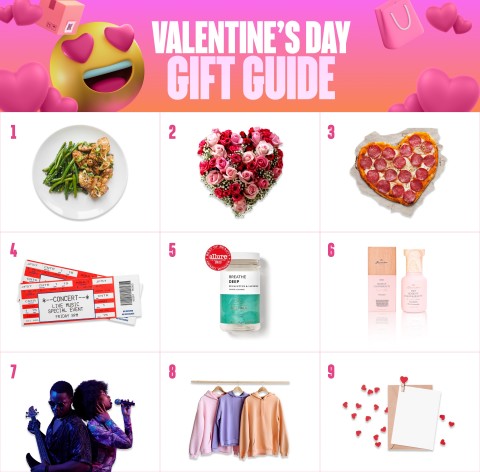

Think of these as all the little extra things that you don’t necessarily need but make your life more enjoyable.

Self care 💅

Shopping 🛍

Eating out 🍝

Gym membership 🏋️

Travel & vacations ✈️

Streaming services (like HBO & Netflix) 📺

Entertainment (like concerts & movies) 🎟

⭐Pro tip: Consider swapping out the occasional manicure for an at-home treatment, boot your friends from Netflix so you can downgrade the membership or host a clothing swap to up your style at no extra cost.

Think of this as your rainy day fund. It’s a place to set aside money in case there’s an emergency or unexpected expense, to pay down debt and also dream big – setting a few savings goals.

Emergency fund 🆘

Credit card debt or personal loans 💳

Short-term savings (like the new PS5) 🎮

Long-term savings (like college or a car) 🎓

⭐Pro tip: If you’re just getting started, always build up your emergency fund (we recommend at least 3 months worth of expenses) and pay down debt first, then move on to saving for other things. At the end of the day, your goals and priorities will always be shifting. For instance, you might up your savings to 30% to focus on college funds, and in turn, scale back on your wants like forgoing the new Social Tourist collection at Hollister. It’s all about finding a balance and never spending more than what you make.

We hope you can use the 50/30/20 rule to jumpstart your budgeting and remember, when in doubt, remind yourself of these 3 things:

Don’t blur the line between your needs and wants.

Revisit your goals often and adjust your spending accordingly.

Saving is a long-term strategy with no end date. Make the most of it.