5 Ways to Maximize Your Tax Refund

Ah, tax season – the annual financial rollercoaster that can be both anxiety-inducing and rewarding. 🎢 Filing taxes can be a maze, especially when you're unsure whether you'll be splurging with a larger refund or tightening your budget to pay up.

But did you know that tax season can also be a golden opportunity? Yep, you might be leaving money on the table if you're not strategizing to maximize your refund. In this guide, we’re walking through a few ways you can ace this yearly financial ritual.

Take advantage of deals and promos

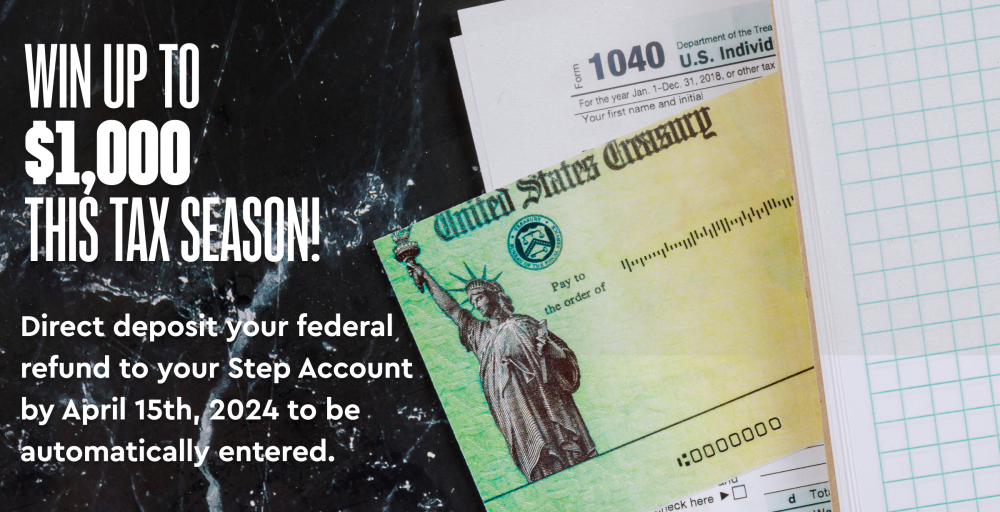

Don't miss out on valuable opportunities to maximize your tax refund and minimize your filing costs. Whether you're eligible for free filing through the IRS Free File program or looking to win a federal tax refund match up to $1,000,¹ we've got you covered:

Don't pay to file your taxes if you don't have to! If you made $79,000 or less last year, you're eligible to file for free. Learn more about the IRS Free File Program here.

Direct deposit your federal refund to your Step Account by April 15th, 2024 to be automatically entered to win a tax refund match up to $1,000! Plus, it's easy and faster than waiting for a paper check to come in the mail.

Start early, stay sane

Filing taxes early is like tackling a major project – procrastination only leads to stress and potential human errors. Who needs that? Gather your paperwork beforehand, and don't be that person sweating out your tax filing on the last day. 😅

For your convenience, below is a list of some of the most common documents needed to file your taxes. Take a peek below and do your research to determine what applies to your specific situation.

W-2 Form: This applies if you were paid more than $600 by an employer throughout the tax year This form is provided by your employer and outlines your annual earnings and the taxes withheld from your paychecks.

1099 Forms: 1099 forms report different types of income, such as interest income (1099-INT), dividend income (1099-DIV), and miscellaneous income (1099-MISC).

W-4 Form: This form is used to determine the amount of federal income tax to be withheld from your paycheck. It's important to keep it updated with your employer.

Proof of Health Insurance Coverage: This can be provided through forms like the 1095-A, 1095-B, or 1095-C, depending on your situation.

Records of Contributions and Deductions: Documentation for any eligible deductions or credits you plan to claim, such as receipts for charitable contributions or records of business expenses.

Proof of Education Expenses: If you're claiming educational credits, you may need documentation such as receipts for tuition and other qualified expenses.

In addition to some of the above listed items, you’ll also need your Social Security Number (SSN) or Taxpayer Identification Number (TIN) for tax identification purposes.

Dive into deductions and credits

Deductions and credits can be your tax-saving superheroes. Deductible expenses shrink your taxable income, while credits directly reduce the tax you owe. Think of deductions as ways to make your taxable income look lower, and credits as discounts on your tax bill. Together, they can help keep more cash in your pocket come tax time.

Now, onto the fun part – common deductions and credits. With a little bit of strategic planning, you can earn tax deductions while supporting causes you care about or making progress on your life goals! This can include:

Charitable contributions 💖

Education expenses 📚

Homeowner perks 🏡

Plus, there are cool credits like the Lifetime Learning Credit and Child Tax Credit that you may be eligible for. Stay sharp by keeping records of your expenses throughout the year, staying updated on tax laws, and consulting a tax professional if you need advice.

Year-round tax moves that matter

Tax planning isn't a once-a-year drill. It's an ongoing process that can have a significant impact on your financial well-being. Here are some important tips to keep in mind throughout the year:

Schedule health check-ups: Consider scheduling necessary health check-ups or medical procedures before the end of the year. By doing so, you can potentially maximize deductions for medical expenses on your returns.

Embrace charitable giving: Not only does giving back to your community feel rewarding, but it can result in significant tax benefits. Be sure to keep records of your donations for filing purposes.

Check out tax-advantaged accounts: Learn about tax-advantaged accounts like Health Savings Accounts (HSAs) and Traditional IRAs. These accounts provide tax benefits and allow funds to grow tax-deferred.

Bring in a pro

Feeling overwhelmed? Consider seeking help from a tax professional! 💪🏼 Navigating the tax code can be tricky, and a financial advisor or tax expert can offer guidance by identifying opportunities for credits and deductions.

What to look for in a professional

Not sure where to begin in your search? Don’t worry! We’ve compiled this short list of key factors to consider when bringing in a tax professional.

Qualifications and credentials: Look for a tax professional with relevant qualifications, such as being a Certified Public Accountant (CPA) or an Enrolled Agent (EA). These designations indicate that the individual has met specific educational and licensing requirements.

Experience: Consider the professional's experience, especially in handling tax situations similar to yours. If you have a complex financial situation, such as self-employment income, investments, or multiple sources of income, you may want someone with experience in those areas.

Fees and transparency: Do you understand their fee structure? Some professionals charge a flat fee, while others charge hourly. Make sure you're aware of all potential fees and any additional costs for specific services. A transparent approach to fees is important.

Availability and accessibility: Ensure that the tax professional will be available when you need them, especially during tax season. Communication is crucial, so opt for a professional that you feel comfortable asking questions to.

Communication skills: Treat taxes as a learning opportunity! Consider choosing a tax professional who can explain complex tax matters in a way that you can understand. Effective communication is key to ensuring you are informed about your tax situation.

Client references: Do you know anyone that's used this person before? Did they have a good experience? Personal recommendations can provide valuable insights into the professional's capabilities and client satisfaction.

By carefully considering these factors, you can find a qualified tax professional who meets your needs and provides you with confidence in the accuracy and completeness of your tax return.

Give your wallet a tax break

So there you have it – start early, ride the deductions and credits wave, make savvy year-end moves, and consider hiring a tax professional to help you. With tax season on your side, you’ll feel more empowered than ever before.