5 Clever Money Gift Ideas to Add to Your Wishlist

Ah, the holiday season – the time for cozy sweaters, festive tunes, and of course, gifts. But let’s face it, sometimes Grandma Gail’s taste in presents doesn’t align with your vibe. 😅

In this blog post, we’ll explore how you can creatively sidestep those unwanted gifts and unwrap the joy of cash without seeming unappreciative. Here are 5 clever money gift ideas to add to your wishlist for any special occasion.💰

1. Savings contributions

If you’re saving for educational expenses, you could explore a 529 plan with your family as a money gift. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Relatives can contribute to it and you can use the funds for a wide range of qualified expenses, like tuition, fees, books, and even certain room and board costs.

Already have a 529 plan? Encourage your loved ones to direct their funds into a savings account for added flexibility. Explore various types, from traditional to high-yield options. Opting for an account that offers a high interest rate can be a great way to grow your money over time. For example, with Step, your savings balance earns 5.00% if you have a qualifying direct deposit¹ or the Step Black Card. That means your money makes money, just by sitting in a Savings Goal! 🙌🏼

2. Investments

Level up your wishlist by venturing into the world of stocks. One of the keys to successful investing is having a long time horizon for your money to grow – and lucky for you, you have time on your side. 🌱 If you're considering incorporating stocks into your money gift wishlist, the approach may vary based on your age.

If you already have a traditional custodial account that your parents or loved ones use to invest for you, you could ask them to purchase a few shares of your favorite companies on your behalf. This is a fun money gift that has the potential to keep on giving! Before you put specific stocks on your list, remember to do your research.

If you don’t have a brokerage account yet, consider asking for one or opening one! With Step, you can invest² in thousands of stocks and ETFs, even as a teen. You’ll just need a parent or guardian to open an account for you if you’re under 18. The best part? You can buy and sell thousands of fractional shares with just your spare change.

Because there are several different ways to receive stocks and each one could have different tax implications (for both you and the gift-giver), consider speaking with a financial advisor or accountant to determine the best gift option for you.

3. Financial literacy resources

Financial skills and knowledge are invaluable gifts that last a lifetime. 📚 If you’re looking for ways to take your financial literacy to the next level, consider adding money-related books, games, accessories (like a wallet or card holder) or apps that can help you confidently master topics like budgeting, building credit, and saving to your wishlist.

As you curate your wishlist, it’s crucial to be mindful of the tools or apps you choose. Some may come with monthly or annual fees that could impact your (or your gift-giver’s) budget. Take a moment to investigate them and note which ones align to your goals. Consider: features and functionality, educational resources, security measures, and cost.

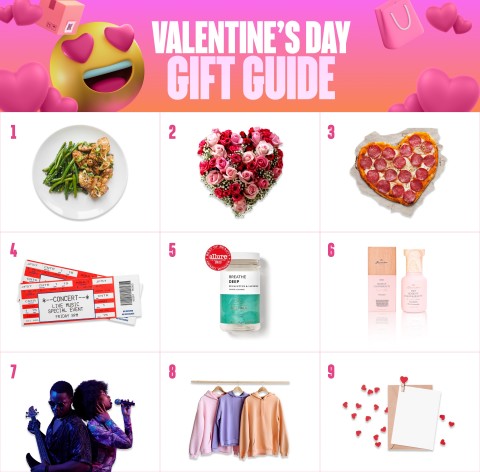

4. Gift cards

When your heart is set on something from a specific store, you have a favorite brand, or just know that your friends and family don’t really get your taste, gift cards can be a great money gift to add to your wishlist. From restaurants, to retailers, and travel, there's a gift card for every interest or special occasion.

While some friends or family may not feel like they’re giving a “real” gift unless it’s beautifully wrapped in a gift box, you can help them overcome this by sharing some of your favorite activities or places to shop. For example, you could say “I love anything from (your favorite store)” or “I really enjoy going out to eat or to the movies with my friends.”

This opens the door for them to contribute in a way that aligns to your tastes. 🛍 Once you receive the gift card, consider letting the gift-giver know how you used it. Whether you went on a shopping spree or enjoyed a night out with pals, letting them know that you put their perfect gift to good use adds an extra layer of gratitude.

5. Donations in your name

If you’re someone who values the spirit of giving, try asking for a charitable donation in your name. Not sure how? Try saying, “This holiday season, I would be truly grateful for a charitable donation to (your chosen charity or cause) in my name.”

This creative money gift can be a great way to create shared joy and a sense of community. 💗 Not only do you as the recipient feel good about supporting a cause that resonates with you, but the gift-giver gets to experience the warmth of contributing, too. Plus, you don't have to worry about keeping track of this like you do with a cash gift.

How can Step help?

From budgeting and saving to investing and credit-building,³ Step is the ultimate sidekick for achieving your financial goals. Whether you're just starting to build your credit history or looking to enhance your money management skills, it's a great gift to add to your wishlist this year!

Friends and family can send you money directly to your Step Account. You can save it, make purchases using your secured credit card, earn rewards, and invest (if you have an approved investing account). Step offers both a free version and a premium version with added perks, so you can enjoy all the financial benefits without being tied down by monthly subscription fees.

Bottom line

While talking about finances can often feel like a taboo, when it comes to your parents or loved ones, don’t be afraid to ask for money-related gifts that can help you establish a strong financial foundation. These clever money gift ideas can be used as birthday gifts, graduation gifts, and holiday gifts. And if you do end up with another ugly sweater (and not the ironic kind), you can always re-gift it next year. 😉